Validating target instances

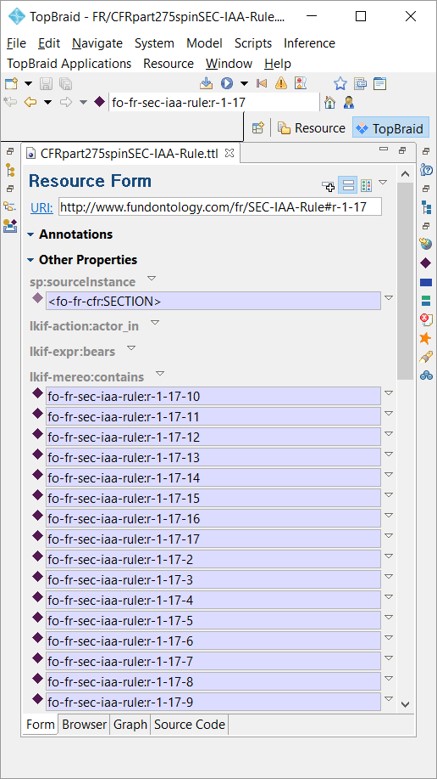

We validate our “Fund Adviser Exemption” in the target ontology. Left is the section instance SEC-IAA-Rule#r-1-17.

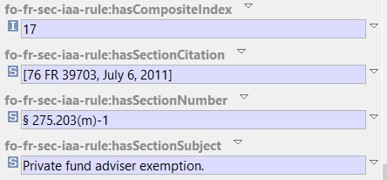

The data properties for index, section citation, number, and subject have been populated.

The data lineage property sp:sourceInstance points to the original CFR Section instance.

Object property lkif-mereo:contains instances for all paragraphs in section r-1-17.

The data properties for index, section citation, number, and subject have been populated.

The data lineage property sp:sourceInstance points to the original CFR Section instance.

Object property lkif-mereo:contains instances for all paragraphs in section r-1-17.

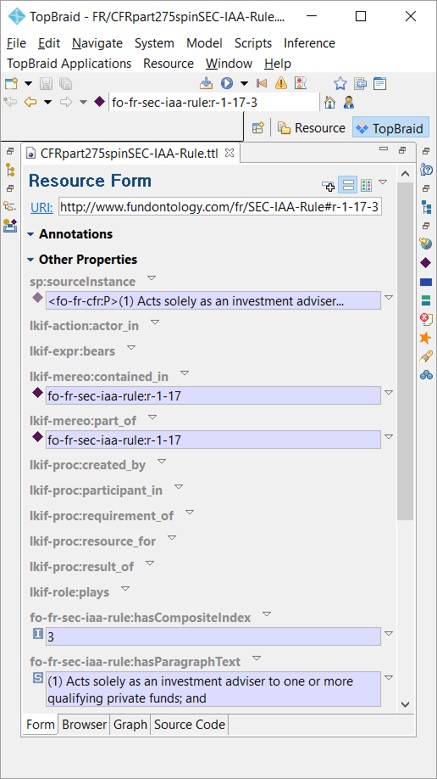

The data lineage property sp:sourceInstance points to the original CFR paragraph instance.

The inverse property contained_in references section r-1-17. Contained_in is rdfs:subPropertyOf part-of. The reasoner will automatically infer a triple for the parent property.

Finally, the paragraph text has been transformed to a data property hasParagraphText.

Validating instances

The graphic shows FRO Section and Paragraph instances and related classes.

All Sections have an object property, fo-fr-legal-ref:divides pointing to the anchor, CFR_Part-275. From the Part, we navigate static Reference Data, which has the CFR Part, Chapter, Title, and Volume. Part 275 also refers to the Securities and Exchange Commission’s rulemaking.

The sp:sourceInstance object properties tie Paragraph and Section instances to their CFR Source.

Querying the graph

The SPARQL query selects Part,

Section and Paragraph with their data properties.

| SELECT ?part ?partText ?section ?sectionIndex ?sectionNumber ?sectionSubject ?sectionCitation ?paragraph ?paragraphIndex ?paragraphText ?paragraphEnumText WHERE { ?part fo-fr-sec-iaa-rule:hasPartText ?partText ?part fo-fr-legal-ref:divided_by ?section ?section fo-fr-sec-iaa-rule:hasCompositeIndex ?sectionIndex ?section fo-fr-sec-iaa-rule:hasSectionNumber ?sectionNumber ?section fo-fr-sec-iaa-rule:hasSectionSubject ?sectionSubject OPTIONAL {?section fo-fr-sec-iaa-rule:hasSectionCitation ?sectionCitation . } ?section lkif-mereo:contains ?paragraph ?paragraph fo-fr-sec-iaa-rule:hasCompositeIndex ?paragraphIndex ?paragraph fo-fr-sec-iaa-rule:hasParagraphText ?paragraphText OPTIONAL {?paragraph fo-fr-sec-iaa-rule:hasParagraphEnumText ?paragraphEnumText} ORDER BY ?part ?sectionIndex ?paragraphIndex | The join from section to paragraph. Not all Paragraphs have an Enum Text. The OPTIONAL keyword will include the record leaving the paragraphEnumText blank. We sort section and paragraph composite index. |

|

The original Private Fund |

The query results reconstitute | |||

| sectionNumber | sectionSubject | paragraphText | paragraphEnumText | |

| § 275.203(m)–1 Private fund adviser exemption.

(a) United States investment advisers. For purposes of section 203(m) of the Act (15 U.S.C. 80b–3(m)), an investment adviser with its principal office and place of business in the United States is exempt from the requirement to register under section 203 of the Act if the (1) Acts solely as an investment adviser to one or more qualifying private funds; and (2) Manages private fund assets of less than $150 million. (b) Non-United States investment advisers. For purposes of section 203(m) of the Act (15 U.S.C. 80b–3(m)), an investment adviser with its principal office and place of business outside of the United States is exempt from the requirement to register under section 203 of the Act if: (1) The investment adviser has no client that is a United States person except (2) All assets managed by the investment adviser at a place of business in the United States are solely attributable to private fund assets, the total value of which is less than $150 million. | § 275.203(m)-1 | Private fund adviser exemption | For purposes of section 203(m) of the Act (15 U.S.C. 80b-3(m)), an investment adviser with its principal office and place of business in the United States is exempt from the requirement to register under section 203 of the Act if the investment adviser: | United States investment advisers. |

| § 275.203(m)-1 | Private fund adviser exemption | (1) Acts solely as an investment adviser to one or more qualifying private funds; and | ||

| § 275.203(m)-1 | Private fund adviser exemption | (2) Manages private fund assets of less than $150 million. | ||

| § 275.203(m)-1 | Private fund adviser exemption | (b) | Non-United States investment advisers. | |

| § 275.203(m)-1 | Private fund adviser exemption | For purposes of section 203(m) of the Act (15 U.S.C. 80b-3(m)), an investment adviser with its principal office and place of business outside of the United States is exempt from the requirement to register under section 203 of the Act if: | Non-United States investment advisers. | |

| § 275.203(m)-1 | Private fund adviser exemption | (1) The investment adviser has no client that is a United States person except for one or more qualifying private funds; and | ||

| § 275.203(m)-1 | Private fund adviser exemption | (2) All assets managed by the investment adviser at a place of business in the United States are solely attributable to private fund assets, the total value of which is less than $150 million. | ||