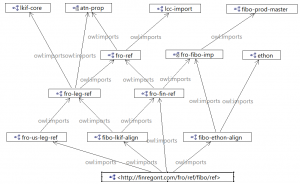

The Financial Regulation Ontologies (FRO) is an open-source design published in the Ontology Web Language (OWL).

FRO is a foundational part of a Semantic Compliance® approach for financial institutions. Ontology Web Language (OWL) is a W3C standard with proven scalability and handling complexity in the Bio and Medical fields. In the ontology, everything is a triple: data, schema, mapping, transformations, rules, … everything is stored in uniform cells of subject-predicate-object.

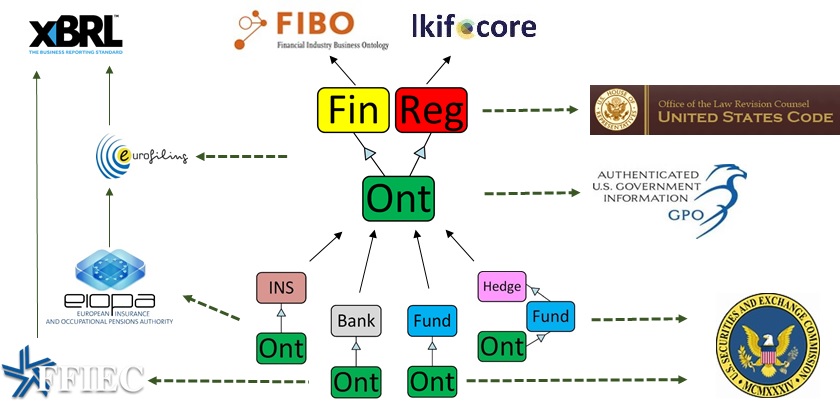

FRO is based on two industry standards:

- FIBO Financial Industry Business Ontology for funds, clients, securities, derivatives, positions, etc.

- LKIF Legal Knowledge Interchange Format for the law, SEC rules, forms, submissions, and responses.

FinRegOnt is the core ontology for Financial Institution compliance. The content is common and needed for all subsectors. The operational ontologies for Insurance, Banking, Funds & Hedge Fund define content specific to the sub-domain:

| Bank Regulation Ontology | http://bankontology.com/ | |

| An RDF/OWL version of the XBRL Bank Call Report (FFIEC 031). Extensions load the Call Report into FIBO and to create XBRL compliant filings. | ||

| | Fund Regulation Ontology | http://fundontology.com/ |

| Semantic rules implement laws and regulations of Dodd-Frank and the Investment Adviser Act. An ontology version of SEC form ADV (advisors) loaded with fund data. The ontology evaluates, whether an advisor must register with the SEC. | ||

| | Hedge Fund Regulation Ontology | http://hedgefundontology.com/ |

| An RDF/OWL version of the XBRL Bank Call Report (FFIEC 031). Extensions load the Call Report into FIBO and create XBRL-compliant filings. | ||

| | Insurance Regulation Ontology | http://insuranceontology.com/ |

| Solvency II reviews the prudential regime for insurance and reinsurance undertakings in the European Union. The ontology defines an RDF/OWL version of the EIOPA XBRL reports/filings. | ||

FRO is populated with the full text of US laws and regulations for banking and investment management:

|

United States Code | |||

|

|

| ||

|

12 |

|

17 |

Bank |

|

53 |

Wall | ||

|

15 |

|

275 |

|

|

Code of Federal Regulations | |||||

|

|

|

Part | |||

|

12 |

|

II |

|

217 |

|

|

225 |

Bank | ||||

|

252 |

| ||||

|

17 |

|

II |

|

275 |

|