The Financial Regulation XBRL ontology is a one-to-one complete OWL/RDF representation of the eXtensible Business Reporting Language schema.

Colleagues know me as a passionate advocate for industry standards and reuse. Google “XBRL ontology” – there are already dozens of hits. Promise: This time it’s different. But first some background …

XBRL is the dominant global standard for exchanging business information.

The Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) mandate financial filings in XBRL. Global adaptation came along with the International Financial Reporting Standards (IFRS). European regulators for Banking and Insurance define reporting requirements as XBRL Taxonomies. The financial institution compliance filings are XBRL instance files.

Semantic Compliance® uses Web 3.0 architecture, methods, and technology to deliver regulatory reporting for financial institutions.

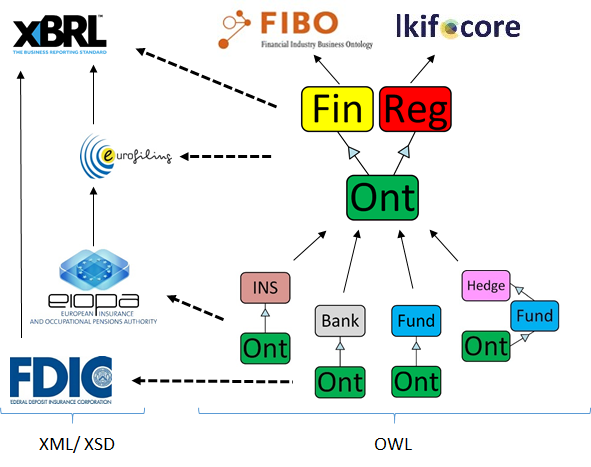

Ontology Web Language (OWL) defines the semantics of concepts, their relationships, and axioms. Compliance crosses the domains of Finance and Legal. Both domains have widely cited and adapted reference ontologies:

The Financial Regulation Ontology (FinRegOnt) extends and aligns the two domain reference ontologies.

An ontology must hold real data, read and write form & report data to be operational.

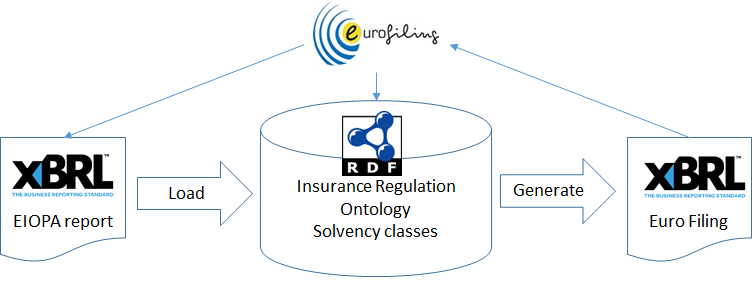

That means the institution’s information stored in FIBO and laws, regulations, and rules in LKIF. The ontology must be able to produce regulatory filings. The US (banking) Call Report, EU (insurance) Solvency II, and many other forms and reports stipulate submission in XBRL. For the European insurance supervisor, EIOPA taxonomy, we needed to produce Eurofiling-compliant XBRL instance files.

Eurofiling is a really revolutionary harmonization. It has taxonomy extensions to XBRL that are common to banking, insurance, securities,, and central bank reporting. (Here in the US, the 50 States still regulate insurance business.)

Why yet another? Quite simply, we needed an XBRL ontology that works for EIOPA and Eurofiling.

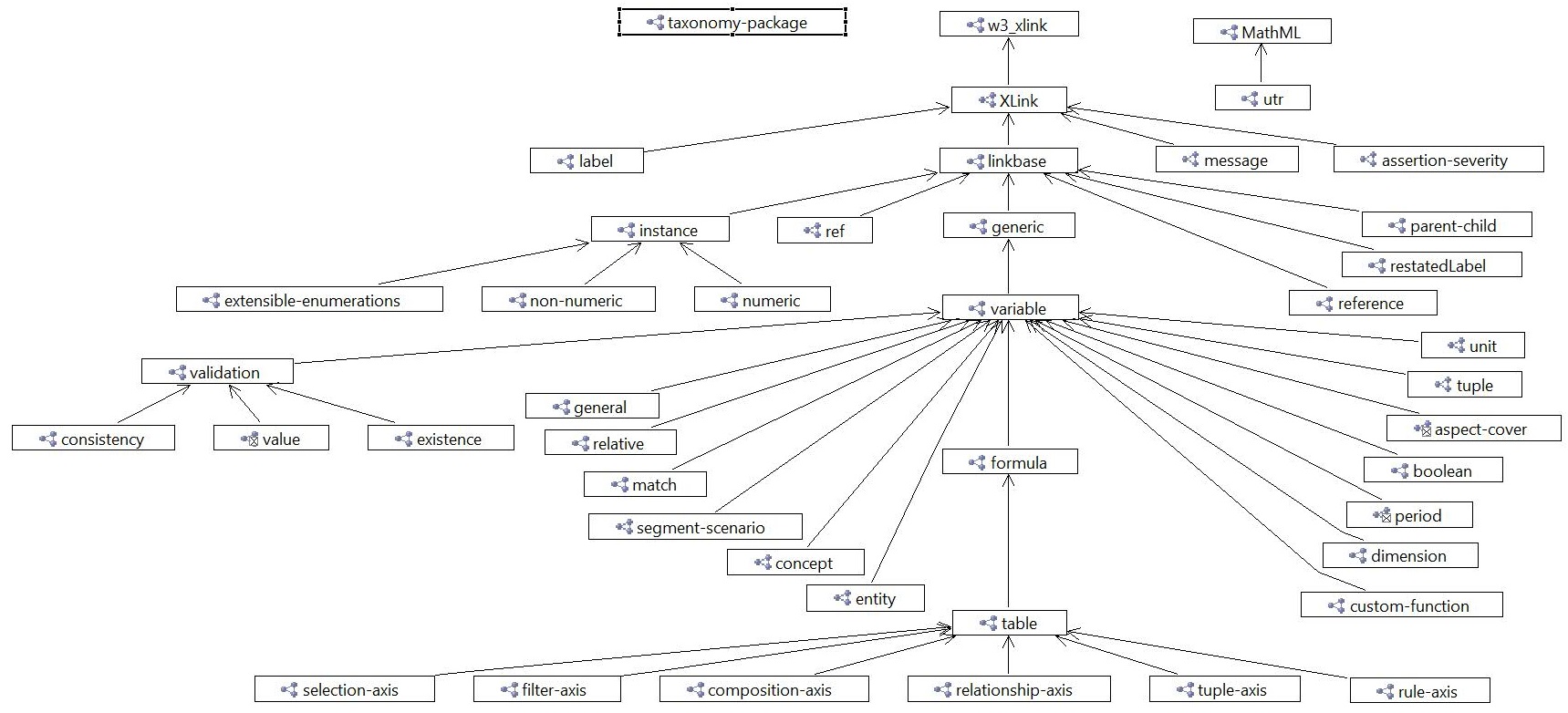

To meet the requirement, the ontology must be complete, covering all elements in the XML schema and all XBRL specifications. The Financial Regulation XBRL ontology is the only Open-Source RDF/OWL that covers all XBRL.org specifications: base (instance, linkbase, Xlink), generic, formula, table, and taxonomy.

I didn’t find any published ontology that fits the bill.

This time it’s different

The FinRegOnt XBRL ontology has all essential specifications. The diagram shows the import graph.

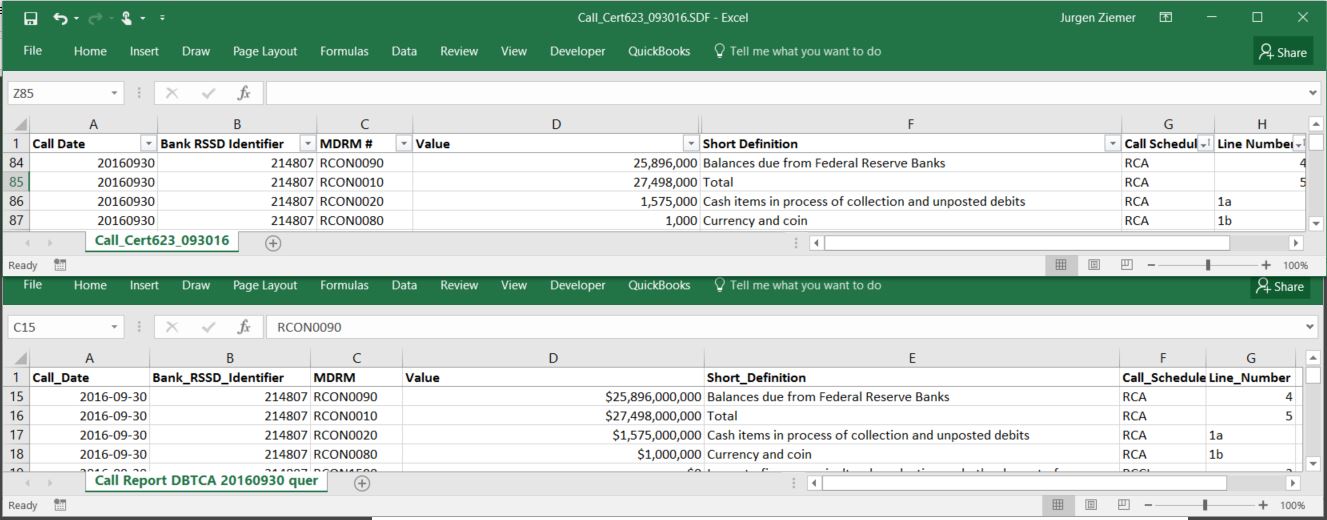

The ontology works for the banking FDIC Call Report. We can load filings and run SELECT statements in SPARQL (the Semantic Web SQL). # The Call Report query reproduces the Excel single Financial Institution report (e.g. Call_Cert623_093016.SDF) # form the raw XBRL/XML ontology import. The result only contains columns with a value (no redacted or derived items).

SELECT ?Call_Date ?Bank_RSSD_Identifier ?MDRM ?Value ?Short_Definition ?Call_Schedule ?Line_Number WHERE { # The call date and RSSD are global identifiers of the file. ?end_date_inst a br-call-db:endDate . ?end_date_inst composite:child ?end_date_node . ?end_date_node sxml:text ?Call_Date . ?ident a br-call-db:identifier . ?ident composite:child ?ident_node .Here is the query. And here, FFIEC public Excel report vs. SPARQL query results.

Next time it will be even better

Enhance the raw import with semantics. Load the Solvency II taxonomy into LKIF, the same as we did for a real ontology model of USC and CFR. Load the report financial information into FIBO classes. The Fund Ontology already has an example of FIBO populated with Investment Advisers from the Securities and Exchange Commission form ADV (advisers) compilation report.

Further Reading

- The complete technical article on the FinRegOnt website (more content tables and less opinionated). With links to the ontology files for download.

- The Financial Regulation tutorial chapter one with a Finance intro to OWL and the reference ontologies.

- Chapter two details reverse engineering XML/XSD, an example of the Code of Federal Regulations (CFR) and the United States Code (CFR).

Thanks for reading his far. I appreaciate your feedback. Please respond with your questions. corrections, and suggestions on LinkedIn or email me jziemer@jayzed.com .