FinRegOnt derived from the Hedge Fund Regulation ontology (HFR).

The semantic approach to compliance implements a hierarchy of defined classes for filing requirements, exceptions, and classification.

The inference engine (reasoner) uses asserted information to infer matching Funds, Advisers, and Assets as members of the defined class. We want the defined class linked to the regulation’s actual paragraph for lineage tractability.

Rather than having endless spreadsheets, we load the regulation into the ontology. Querying from regulation to implementation shows the classes where a particular requirement has been implemented.

The regulatory classes for the Code of Federal Regulations (CFR) and United States Code (USC) are not specific to Alternative Investments or specific to finance. All USC and CFR XML can be loaded into the ontology.

The XML provided by the Government Publishing Office and Office of the Law Revision Council is a great service to the public. Hopefully, it will be even better with RDF/OWL semantic endpoints integrating all US E-Government.

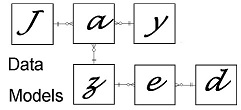

Jayzed Data Models Inc. consulted major North America, Europe, and Asia banks since 1999.

Jurgen Ziemer was an IBM Industry Models, Banking Data Warehouse Consultant for 6 ½ years—leading data architecture for Bank compliance projects since Basel II in 2003.

I converted from data modeling to ontologies three years ago. Using OWL, I can define business constraints as axioms of the class structure. Executable business rules can be formulated in defined classes and semantic web rules. Traditional architecture has all these components separately (RDBMS, ETL, rules engine …). Different metadata representations make it so hard to integrate.

Please email your questions, corrections, and suggestions to jziemer@jayzed.com